Where Smart Money is Going in 2025: Key Investment Themes

Rafael Benavente outlines the top investment strategy themes for 2025, including key stocks, sectors, and asset classes for a volatile global market.

Top Investment Strategy Themes for 2025: Stocks and Sectors to Watch

I. Introduction – The 2025 Investment Landscape

The 2025 investment environment is defined by an unusual mix of slowing global growth, persistent inflation in select regions, and geopolitical uncertainty. The U.S. Federal Reserve has signaled a “higher for longer” interest rate stance, inflation is stabilizing in the eurozone, and China’s economy is navigating structural transitions.

For investors, the lesson of the past two years has been clear: adaptability beats prediction. The winners of 2025 will be those who can balance offense and defense, using tactical flexibility while staying aligned with long-term megatrends.

II. Theme 1 – The Return of Quality Growth

After years of chasing high-momentum and speculative growth stories, investors are returning to the fundamentals:

- High Return on Equity (ROE)

- Strong Free Cash Flow

- Low Leverage

Example Stocks:

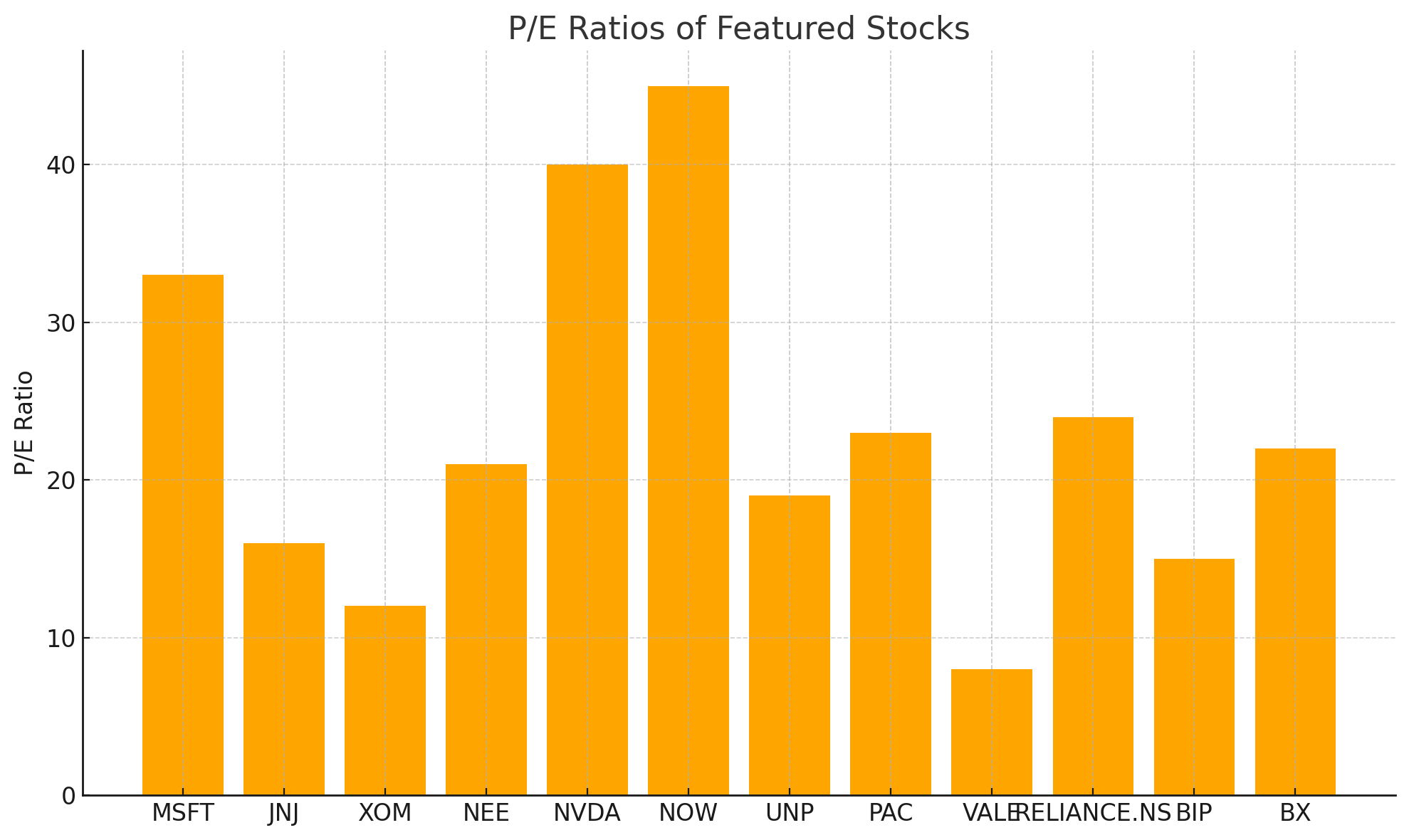

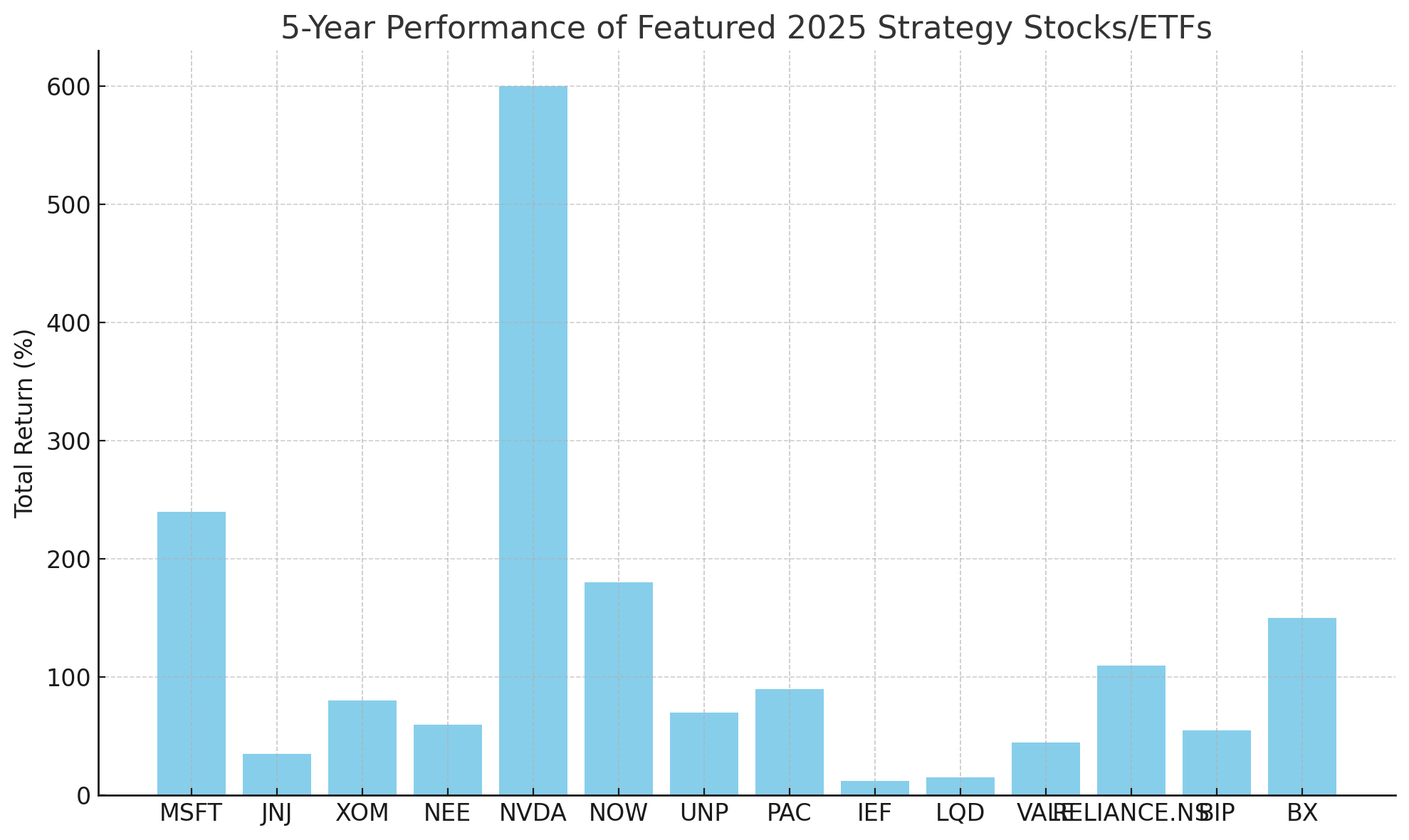

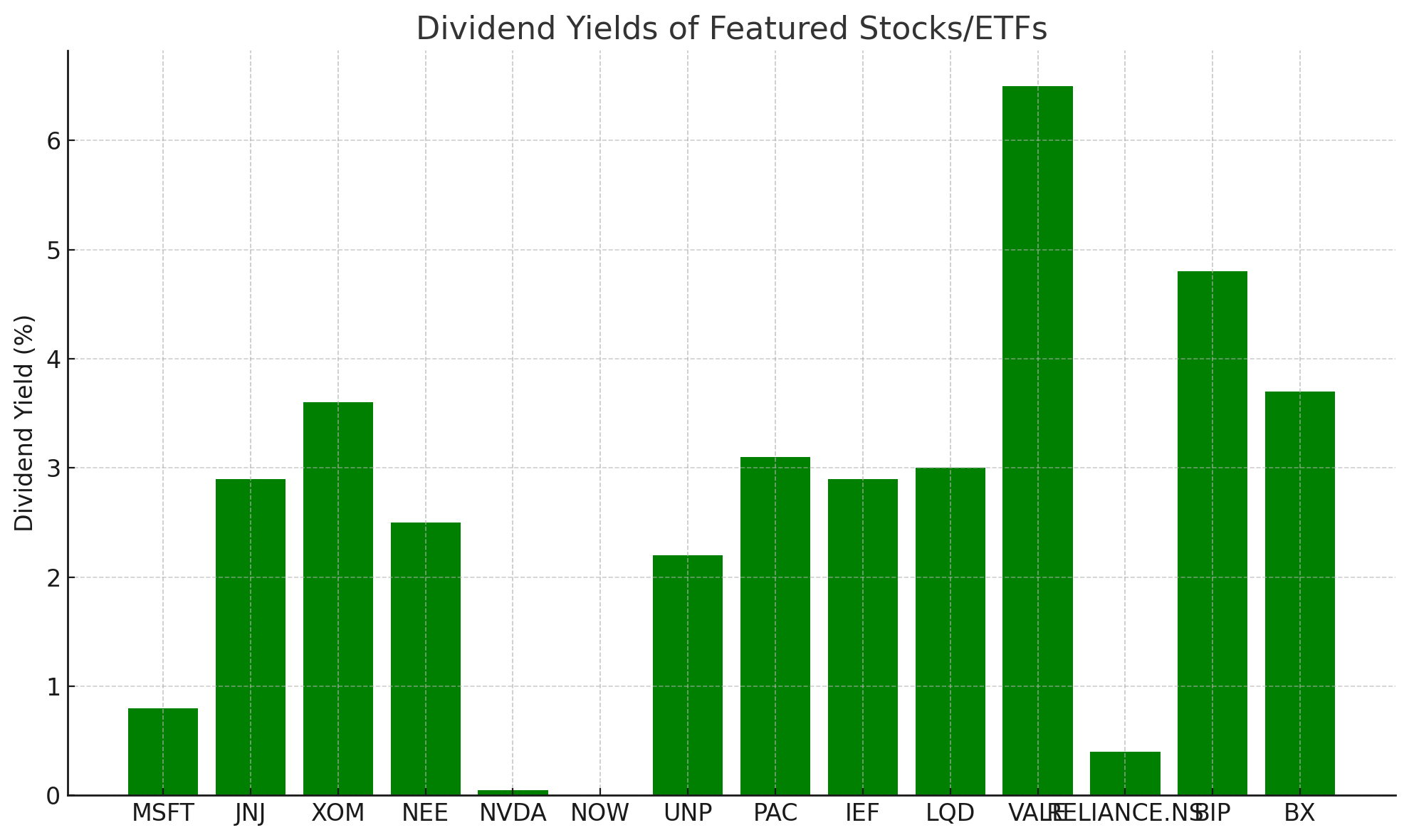

- Microsoft (MSFT) – Strong ROE, recurring SaaS revenues, AI integration into enterprise products.

- Johnson & Johnson (JNJ) – Diversified healthcare leader with resilient earnings.

III. Theme 2 – Energy Transition 2.0

Energy strategy in 2025 is no longer an “either/or” between fossil fuels and renewables — it’s about dual-track positioning:

- Traditional Energy: Oil & gas majors for stable cash flows and dividends.

- Renewable Infrastructure: Developers with strong project pipelines.

Example Stocks:

- ExxonMobil (XOM) – Reliable dividend payer, disciplined capex in traditional energy.

- NextEra Energy (NEE) – U.S. leader in renewables and battery storage.

IV. Theme 3 – AI and Digital Transformation Beyond the Hype

The AI investment wave of 2023–2024 drove massive capex spending by hyperscalers and enterprise adopters. 2025 is the year that separates hype from execution.

Example Stocks:

- Nvidia (NVDA) – AI hardware leader with an expanding software ecosystem.

- ServiceNow (NOW) – Enterprise workflow automation leader embedding AI to boost productivity.

V. Theme 4 – Global Supply Chain Rewiring

Global trade dynamics are shifting in response to economic and political pressures:

- Reshoring: Bringing manufacturing back to the U.S.

- Nearshoring: Moving production to Mexico and Central America.

- Friendshoring: Relocating supply chains to politically aligned countries.

Example Stocks:

- Union Pacific (UNP) – Rail logistics backbone supporting U.S. reshoring trends.

- Grupo Aeroportuario del Pacífico (PAC) – Mexican airport operator benefiting from nearshoring and trade flows.

VI. Theme 5 – Fixed Income’s Comeback

With yields at multi-decade highs, bonds are back as a serious portfolio anchor.

Example ETFs:

- iShares 7-10 Year Treasury ETF (IEF) – Intermediate U.S. Treasury exposure for defensive allocation.

- iShares iBoxx Investment Grade Corporate Bond ETF (LQD) – High-quality corporate bonds.

VII. Theme 6 – Emerging Markets Selectivity

2025 is not a “buy everything” year for emerging markets. Instead, focus on selective plays with strong macro tailwinds.

Example Stocks:

- Vale S.A. (VALE) – Brazilian mining giant leveraged to global commodities demand.

- Reliance Industries (RELIANCE.NS) – India’s largest company with energy and digital growth engines.

VIII. Theme 7 – Private Markets and Alternative Assets

Institutional and high-net-worth investors are leaning more heavily into private markets:

- Private Credit: Filling gaps left by bank lending retrenchment.

- Infrastructure: Inflation-linked contracts in transportation, energy, and water utilities.

Example Stocks:

- Brookfield Infrastructure Partners (BIP) – Global infrastructure operator with inflation-protected revenues.

- Blackstone (BX) – Leading alternative asset manager with exposure to private credit and real estate.

IX. Risk Factors Across All Themes

Key risks in 2025 include:

- Interest Rate Shocks – Unexpected tightening or delayed cuts by central banks.

- Geopolitical Events – Escalation in Eastern Europe, South China Sea, or the Middle East.

- Regulatory Changes – Particularly in tech, energy, and finance.

- Climate-Related Events – Supply chain disruption and insurance cost surges.

X. Conclusion – Positioning for 2025 and Beyond

For 2025, portfolio construction is about balance and flexibility:

- Anchor allocations in quality growth equities and select fixed income.

- Maintain optionality through cash reserves or liquid ETFs for opportunistic entry.

- Use alternatives and private markets for inflation protection and diversification.

The global economy is entering a period where macro volatility is the norm. Successful investors will position portfolios to capture targeted upside while defending against systemic shocks.

By Rafael Benavente

If you would another article by Rafael Benavente on investments for Floridians