The Magnificent Seven’s Next Chapter: Who Will Lead in the Post-AI Market Era?

From Magnificent Seven to Magnificent Few: Tech Leadership in the Post-AI Hype Era-Rafael Benavente

By Rafael Benavente

From Magnificent Seven to Magnificent Few: Tech Leadership in the Post-AI Hype Era

I. Introduction – A Decade of Market Domination

Over the last decade, the U.S. equity market has witnessed an extraordinary concentration of gains in a handful of mega-cap technology and growth companies now famously dubbed the “Magnificent Seven”: Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOGL), Tesla (TSLA), and Meta Platforms (META).

These seven names, representing less than 2% of the S&P 500’s constituents, have at times contributed over 70% of the index’s annual gains. The drivers of this dominance have been well-documented: technological innovation, platform monopolies, relentless share buybacks, and, more recently, the explosive investor enthusiasm around artificial intelligence (AI).

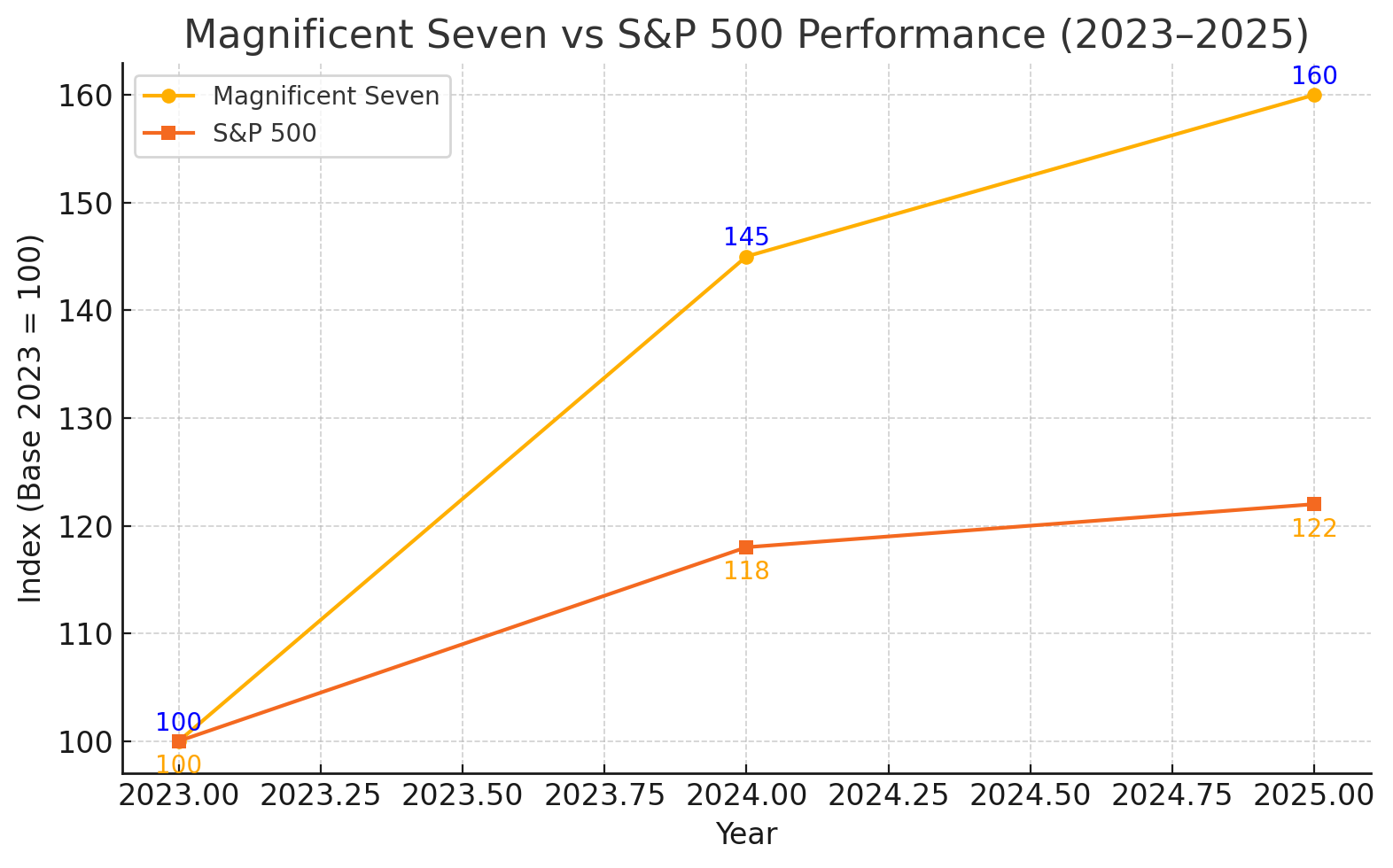

The performance gap between these companies and the broader market is stark:

Over the 2015–2024 period, the Magnificent Seven’s market cap grew by more than 300%, while the rest of the S&P 500 delivered a far more modest ~100% total return.

II. The AI Catalyst and the Post-Hype Reality

The 2023–2024 period brought AI to the forefront of market narratives. Nvidia became the undisputed poster child of the AI hardware boom, Microsoft’s Azure and Office integrations monetized early AI adoption, and Meta leveraged AI to supercharge advertising targeting efficiency.

However, as 2025 begins, a post-hype reality check is setting in:

- AI monetization timelines are proving longer than initial investor hopes.

- Capital expenditures are ballooning for cloud providers and hyperscalers to maintain competitive GPU infrastructure.

- Some consumer-facing AI applications are struggling to find sustainable revenue models.

This does not mean the AI story is over — far from it — but it does mean the “rising tide lifts all boats” phase is ending. Investors are becoming more selective, and Wall Street research desks are increasingly focused on separating sustainable earnings growth from thematic hype.

III. Breaking Down the Magnificent Seven

1. Apple (AAPL)

- Valuation: ~28x forward earnings (2025E)

- Growth Drivers: Services revenue (App Store, Apple TV+, AppleCare), wearables, and ecosystem lock-in.

- Risks: iPhone revenue maturity, regulatory pressure in the EU and U.S., China supply chain exposure.

- Broker Outlook: Goldman Sachs sees modest upside with price target implying 8–10% growth, noting that services margins remain resilient even in slower hardware cycles.

2. Microsoft (MSFT)

- Valuation: ~33x forward earnings

- Growth Drivers: Azure’s expanding market share, AI-powered Copilot integration in Office 365, enterprise AI adoption.

- Risks: Competition in AI services from Google and AWS, regulatory scrutiny in cloud services.

- Broker Outlook: Morgan Stanley calls Microsoft the “best positioned large-cap AI monetizer,” with AI revenue potentially contributing $20B annually by 2027.

3. Nvidia (NVDA)

- Valuation: ~40x forward earnings (still rich after doubling in 2023–24)

- Growth Drivers: GPU dominance in AI training and inference, CUDA software ecosystem, early entry into AI networking (InfiniBand).

- Risks: Rising competition from AMD, Intel, and in-house chips from hyperscalers; cyclicality in semiconductor demand.

- Broker Outlook: Goldman Sachs reiterates “Buy” but flags the risk of “over-earning” in current AI cycle.

4. Amazon (AMZN)

- Valuation: ~35x forward earnings

- Growth Drivers: AWS stabilization, improved retail margins, logistics efficiency gains, and Prime Video expansion.

- Risks: Cloud price competition, e-commerce margin compression, potential antitrust remedies.

- Broker Outlook: Bank of America sees AWS regaining growth momentum in 2H 2025, projecting double-digit cloud revenue CAGR through 2027.

5. Alphabet (GOOGL)

- Valuation: ~21x forward earnings

- Growth Drivers: AI integration in search, YouTube growth, Google Cloud profitability inflection.

- Risks: AI-generated answers cannibalizing ad clicks, regulatory scrutiny in digital ads.

- Broker Outlook: Citi is cautiously optimistic, expecting AI to be a “net positive” for ad revenue by 2026 after a transitional adjustment.

6. Tesla (TSLA)

- Valuation: ~50x forward earnings (down from peak >100x)

- Growth Drivers: Energy storage, software subscriptions (FSD), and cost reductions in new vehicle platforms.

- Risks: EV demand slowdown, price wars in China, competition from BYD and legacy automakers.

- Broker Outlook: Goldman Sachs remains Neutral, citing “credible long-term optionality” in energy and autonomy but near-term demand headwinds.

7. Meta Platforms (META)

- Valuation: ~20x forward earnings

- Growth Drivers: AI-driven ad targeting, Reels monetization, Reality Labs long-term optionality.

- Risks: Metaverse investment drag, regulatory scrutiny in data privacy.

- Broker Outlook: UBS sees upside driven by continued efficiency in ad load and engagement metrics.

IV. Shrinking Leadership – Toward a “Magnificent Few”

The Magnificent Seven moniker may not survive the next few years in its current form. While Microsoft, Nvidia, and Amazon appear well-positioned for continued leadership, others face growth deceleration or margin pressure.

Goldman Sachs’ equity strategy team notes that in prior market cycles, such as the 1970s “Nifty Fifty” and the late 1990s dot-com bubble, leadership concentration eventually narrowed, with only a fraction of initial leaders sustaining outperformance over a decade.

V. Valuation Trends and Growth Drivers

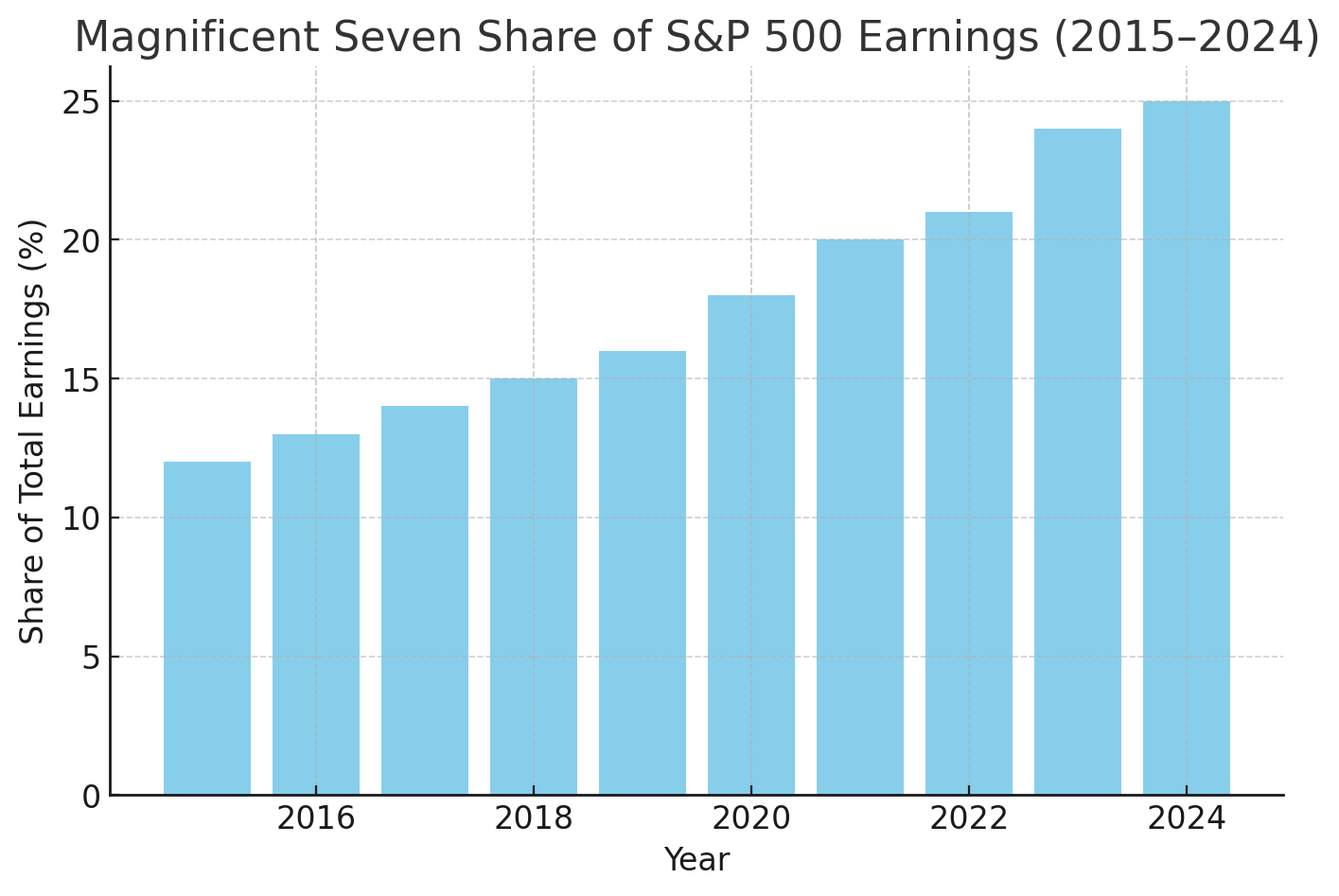

From 2015 to 2024:

- Market cap concentration: The Magnificent Seven’s share of S&P 500 market cap grew from ~14% to ~30%.

- Earnings contribution: They now account for ~25% of index earnings, up from ~12% a decade ago.

- Valuation expansion: Average forward P/E rose from ~20x in 2015 to ~32x in 2024.

Growth drivers going forward:

- Enterprise AI adoption (cloud, productivity, and vertical-specific applications)

- Platform monetization (ecosystem lock-in, subscription models)

- Capital discipline (slower hiring, targeted capex)

- Regulatory navigation (ability to adapt business models under scrutiny)

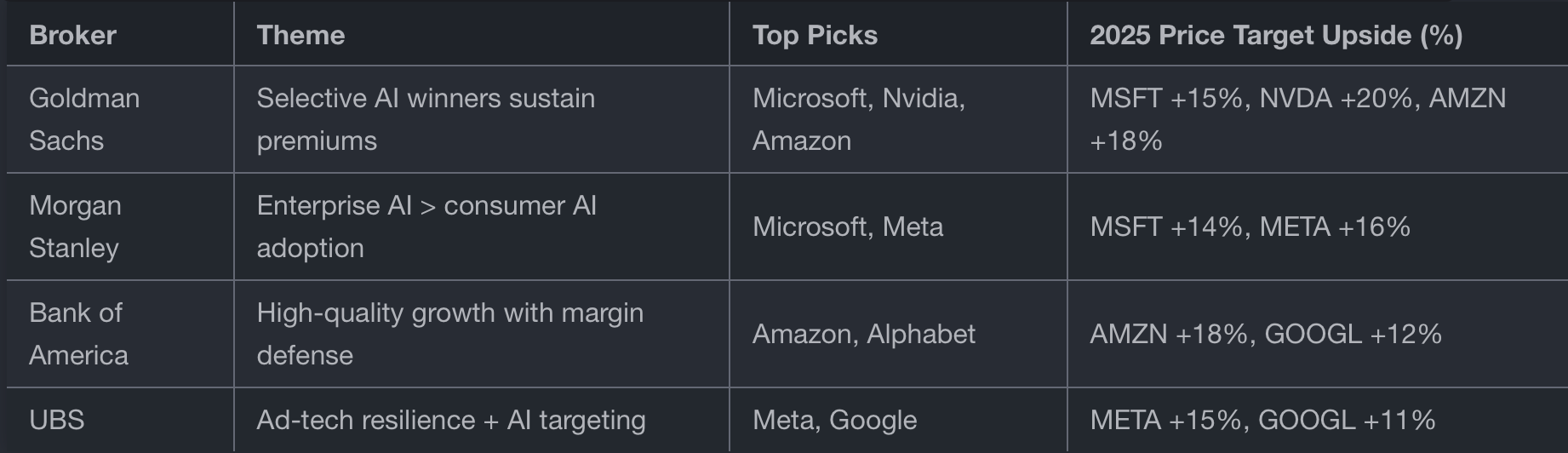

VI. Broker-Dealer Outlook for 2025–2027

Goldman Sachs

- Theme: Selective AI winners will sustain premium multiples; others will revert to market-like returns.

- Top Picks: Microsoft, Nvidia, Amazon.

- Risks: Overestimation of AI monetization timelines; macro-driven multiple compression.

Morgan Stanley

- Theme: AI adoption curve steeper in enterprise software than in consumer apps.

- Top Picks: Microsoft, Meta.

Bank of America

- Theme: Rotation into high-quality growth with defensible margins; cloud providers to lead tech earnings growth.

- Top Picks: Amazon, Alphabet.

UBS

- Theme: Ad-tech resilience + AI-enhanced targeting will drive Meta and Google upside.

VII. Strategic Takeaways for Investors

- Concentration Risk Is Real – A narrower group of tech leaders means portfolios tied to “Magnificent Seven” ETFs or indices are increasingly exposed to single-stock risk.

- AI Is Not a Rising Tide – Differentiation in execution and monetization will drive the next leg of returns.

- Watch Macro and Rates – Tech valuations remain sensitive to U.S. Treasury yields; higher-for-longer rate scenarios cap multiple expansion.

- Diversify Within Innovation – Consider mid-cap tech innovators, industrial automation, and defense tech for balanced exposure.

VIII. Conclusion – Beyond the Branding

The AI megatrend remains one of the most important investment themes of the next decade. But as the hype phase fades, the path forward will be defined by earnings delivery, capital discipline, and regulatory agility.

The Magnificent Seven as a group may give way to a Magnificent Few, but for investors who can identify the enduring leaders, the next decade could still be as rewarding as the last — just with more selectivity required.