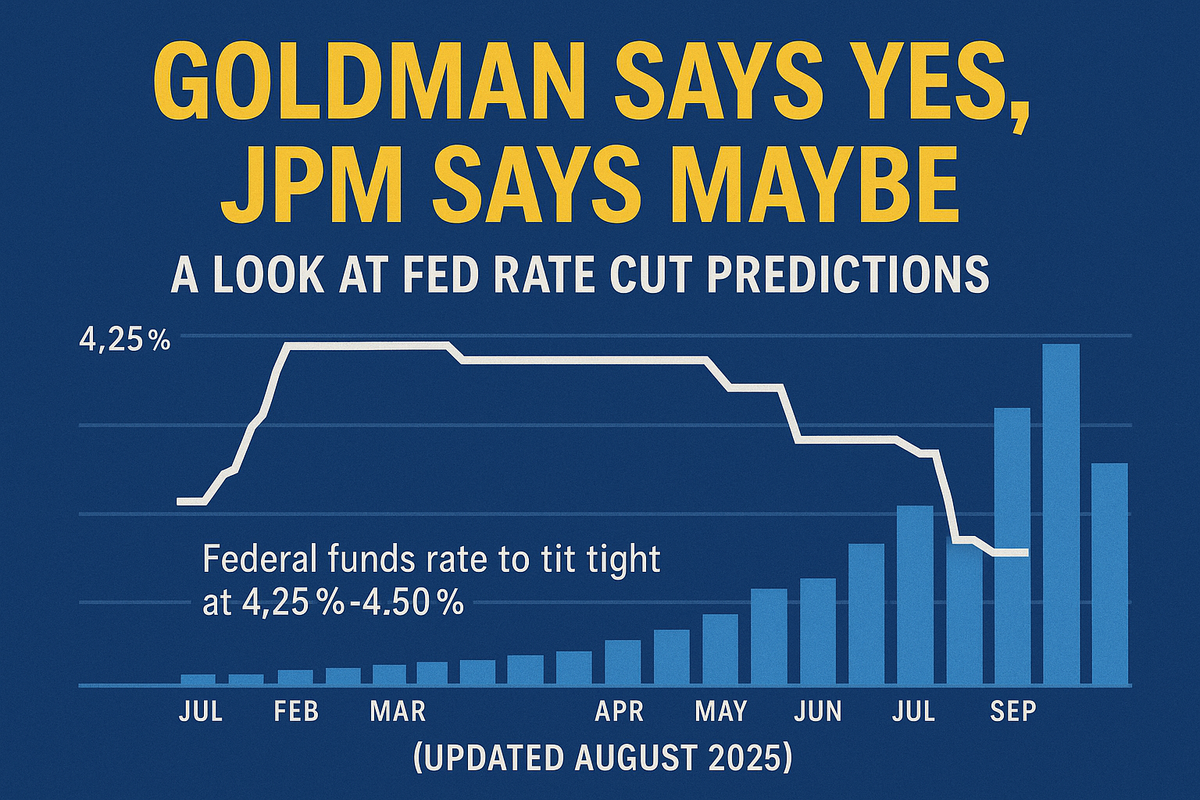

September Cut Almost Certain: Goldman, JPM, and the New Fed Rate Playbook

Goldman Sachs has gone all-in on three cuts this year, J.P. Morgan pulled forward its call to September with four cuts total, and consensus economists are clustered around two moves.

By Rafael Benavente

Goldman Says Yes, JPM Says Maybe: A Look at Fed Rate Cut Predictions (Updated August 2025)

The Fed continues to sit tight with the funds rate at 4.25%–4.50%, unchanged at the July 31 FOMC. But markets and Wall Street desks are increasingly convinced the first cut is imminent. After the July CPI print came in softer than expected, futures markets now price a September cut with mid-90s% odds.

What’s new since midsummer: Goldman Sachs has gone all-in on three cuts this year, J.P. Morgan pulled forward its call to September with four cuts total, and consensus economists are clustered around two moves. Mortgage rates are at their lowest since October, and 10-year Treasury yields look pinned near 4.3% for the coming year.

Broker-dealer projections (updated Aug 2025)

| Institution / Source | 2025 Cuts | First Cut Timing | End-2025 Fed Funds (target range) | Notes |

|---|---|---|---|---|

| Goldman Sachs | 3 | September | ~3.50%–3.75% | Plus 2 cuts in 2026 → terminal ~3.00%–3.25%. |

| J.P. Morgan | 4 | September | ~3.25%–3.50% | Brought forward from a December start; three more cuts after Sept. |

| Reuters economist poll (consensus) | 2 | September | ~3.75%–4.00% | September + one additional cut by year-end. |

| FOMC (June SEP “dot plot”) | 2 | N/A (data-dependent) | ~3.75%–4.00% | Official projections as of June; policy still 4.25%–4.50%. |

1) Fed Funds Rate

- Current target: 4.25%–4.50%, unchanged at the July 31 FOMC.

- Market odds: Fed funds futures put a September 25 bp cut in the mid-90s% after July CPI.

- Street views:

- Goldman Sachs: Sep/Oct/Dec cuts (3 total in 2025), then two in 2026.

- J.P. Morgan: Four cuts starting September.

- Consensus economists (Reuters poll): Two cuts in 2025 (Sep + one more).

- FOMC projections: The June dot plot still points to two 2025 cuts, underscoring data dependence.

2) 10-Year Treasury Yield

- Current level: around 4.25%–4.30%.

- Strategist medians (Reuters Aug poll): yields seen ~4.30% in three months and in a year, essentially flat from here.

- Market color: occasional spikes (like Tradeweb’s flagged misprint) have been flow-driven rather than tied to fundamentals.

3) 30-Year Fixed Mortgage Rates

- Latest weekly average (Freddie Mac PMMS): 6.58% (week of Aug 14, 2025), the lowest since October.

- Updated forecasts:

- Fannie Mae ESR (July): ~6.4% end-2025, easing to ~6.0% end-2026.

- Industry roundups keep the mid-6% range through late 2025, before gradual easing into 2026.

Commentary & Risks

- Path risk: While futures price a September cut with near-certainty, the Fed has avoided pre-committing. July’s statement offered no explicit signal of imminent easing.

- Inflation mix: July CPI was benign on headline terms, boosting cut odds; but the FOMC is watching core services closely.

- Labor market: Cooling job growth helped pull forward J.P. Morgan’s timeline, but any re-acceleration could push later cuts back.

- Term premium & supply: Heavy Treasury issuance plus tariff-related inflation risks are why strategists see the 10-yr pinned near ~4.3% even with easing ahead.

Bottom Line

Markets are almost unanimous on September as liftoff for cuts. Beyond that, divergence remains: Goldman sees a steady three-cut pace this year, J.P. Morgan goes more aggressive with four, and consensus economists stick to two. The Fed itself is still at two.

Mortgage borrowers are already benefitting, with 30-year fixed rates at the lowest in nearly a year. But Treasury yields suggest longer-term rates won’t collapse quickly.

For investors, that means:

- Short end: strong conviction in September cuts.

- Long end: sticky yields around 4.3% as structural forces (supply, risk premia) offset Fed easing.

- Housing: steady relief but not a return to the ultra-low era anytime soon.

The Fed’s next meeting will be the decisive test. Until then, “yes,” “maybe,” and “two cuts at most” are all still on the table — depending on which desk you ask.

By Rafael Benavente

if you want to see another related blog by Rafael Benavente, Fed Cut Predictions Aug 1 2025