Saks Global’s $600M Debt Exchange: A Luxury Giant in Distress

bond indenture had loose covenants—permitting Saks to issue senior debt against its flagship Fifth Avenue store and shuffle creditor priority—laying the groundwork for creditor conflict. -Rafael Benavente

By Rafael Benavente

Saks Global’s Debt Exchange: A High-Stakes Gamble in Luxury Retail Finance

Introduction

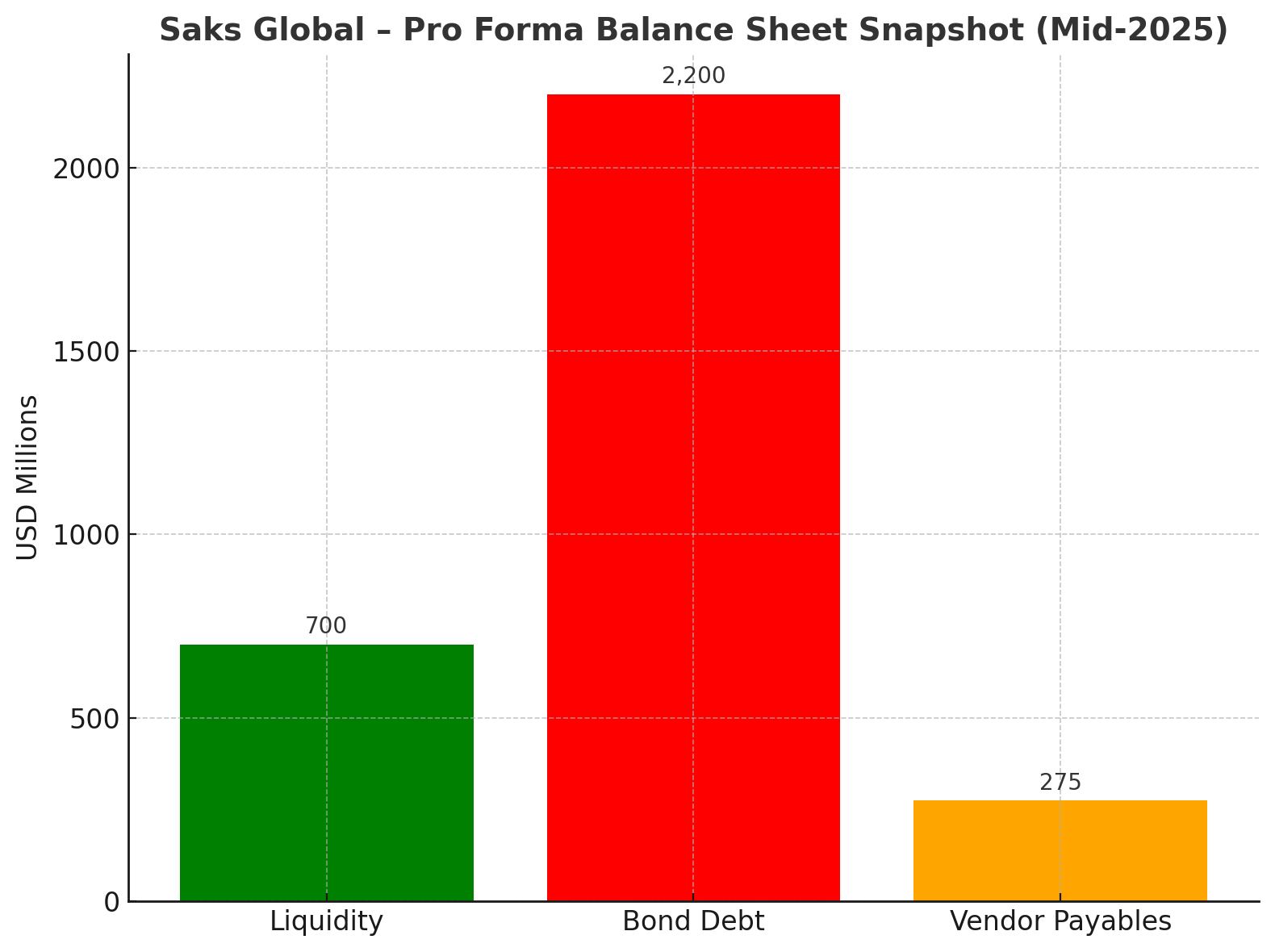

In 2025, luxury retail conglomerate Saks Global Enterprises—formed through the merger of Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman—faced its biggest financial test yet. Burdened with a $2.2 billion, 11% high-yield bond package and skyrocketing vendor obligations, the company launched a complex debt exchange and consent solicitation to preserve liquidity and restructure its balance sheet.

Let’s unpack what happened, why it matters—and what it teaches investors about the risks hiding in fancy bond covenants.

1. The Backstory: Creation, Overextension & Weak Covenants

- Saks Global emerged in December 2024, following the acquisition of Neiman Marcus for $2.7 billion. This created one of the largest luxury department store entities in America. Bloomberg Law+6Bloomberg.com+6Retail Dive+6Retail Dive+4PR Newswire+4The Business of Fashion+4Financial Times+1Wikipedia+1

- To fund the merger, Saks issued $2.2 billion in 11% senior secured notes due 2029 in late 2024. PR Newswire+3The Business of Fashion+3Bloomberg Law+3

- Soon after, cracks appeared: vendor payments were delayed, inventory replenishment suffered, and bondholders began to question their position in the capital structure. Bloomberg.com+4Financial Times+4Financial Times+4

Critically, the bond indenture had loose covenants—permitting Saks to issue senior debt against its flagship Fifth Avenue store and shuffle creditor priority—laying the groundwork for creditor conflict. Financial Times+3Financial Times+3New York Post+3

2. Cash Crunch & Rising Pressure

By mid-2025, the company was facing a liquidity crunch:

- Overdue payables exceeded $275 million, straining vendor relationships and supply chains. New York PostVogue Business+1

- Fiscal 2024 ended with a 10% drop in revenue and a $102 million loss, highlighting vulnerability amid weak luxury spending. New York Post

- Bonds tumbled to 30‑35¢ on the dollar, signaling eroding investor confidence. Bloomberg.com+8Financial Times+8New York Post+8

Saks urgently needed to raise capital—to make interest payments, stabilize operations, and restore vendor trust. Bloomberg.com+15Wall Street Journal+15Vogue Business+15

3. The $600M Lifeline — Structured to Favor the Majority

On June 27, 2025, Saks announced a $600 million financing package from bondholders:

- $300 million in immediate cash was provided by a group holding over half the bonds (54%). These financiers secured senior priority in claims.

- Another $300 million required a debt exchange: remaining creditors swap their bonds for new notes with the same 11% coupon and 2029 maturity—but lower repayment priority, meaning they’d rank below the senior exchange holders. Retail Dive+15The Business of Fashion+15New York Post+15Financial Times+1

Failing to participate meant being pushed to the bottom of repayment and stripped of covenants. New York Post

4. Execution & Market Fallout

The exchange executed quickly:

- By August 1, around 98% of bondholders tendered their old notes and consented to the exchange. Bloomberg Law+1

- Saks received $300 million in proceeds and issued multiple tranches of new debt: SPV Notes, Second-Out, and Third-Out Exchange Notes. The restructuring captured $115 million in principal discount. PR Newswire+1

- However, S&P treated the transaction as a "selective default", downgrading Saks’ rating, and signaling ongoing credit risk. Bloomberg.com

5. Credit-Workers vs. Creditors: The Fallout for Bond Investors

This case exemplifies “creditor-on-creditor violence”:

- The majority of bondholders advanced cash and secured senior status, while minority holders took haircuts and lost protection. Financial Times+1

- The situation underscores how weak covenants and aggressive maneuvers can reshape creditor hierarchy swiftly and legally. Financial Times

FT’s coverage refers to “investors angered as Saks leveraged weak covenants to restructure debt… haircuts up to 25%.” Financial Times

6. Strategic Implications & Risks Ahead

For Saks Global:

- The financing provides short-term relief and time to execute a turnaround, but substantial challenges remain in consumer demand and vendor trust. Bloomberg.com+9Vogue Business+9The Times+9

For Credit Investors:

- It’s a warning: entry at par in mid-yield issues doesn’t guarantee priority or safety if covenants are weak.

- Sovereign or retail-focused bond issuers may replicate these strategies—meaning buyers must scrutinize terms aggressively.

Broader Credit Market Reflection:

- The case shines a spotlight on systemic risk in leveraged loan and junk bond markets: aggressive issuer tactics, regulatory gaps, and risk complacency. Financial Times

7. Summary Table

| Participant | Outcome in Exchange |

|---|---|

| Majority Bondholders | Provided $300M, obtained senior notes at par—protecting repayment priority |

| Minority Bondholders | Forced into lower-tier notes, 20–25% haircut, lost covenant protections |

| Saks Global | Gained $600M in liquidity, avoided bankruptcy for now, tarnished credit rating |

| Credit Market | Exposed risk of poorly negotiated covenants and aggressive issuer-led exchanges |

Conclusion

The Saks Global 2025 debt exchange is a high-stakes drama in the world of retail finance. A bold financing move, leveraged through weak covenants and creditor coercion, has restructured liabilities—but at the cost of trust and credit rating.

By Rafael Benavente