Global Energy in 2025: Oil Cartels, Gas Routes, and the Green Power Shift

OPEC pivots to market share, LNG trade flows shift, and critical minerals reshape the green transition—here’s what it means for global energy politics.-Rafael Benavente

By Rafael Benavente

Global Energy Politics in 2025: OPEC Strategy, LNG Routes, and the Geopolitics of the Green Transition

OPEC pivots to market share, LNG trade flows shift, and critical minerals reshape the green transition—here’s what it means for global energy politics.

Key Takeaways

- OPEC+ has shifted from price defense to market share growth, adding supply despite weakening demand growth.

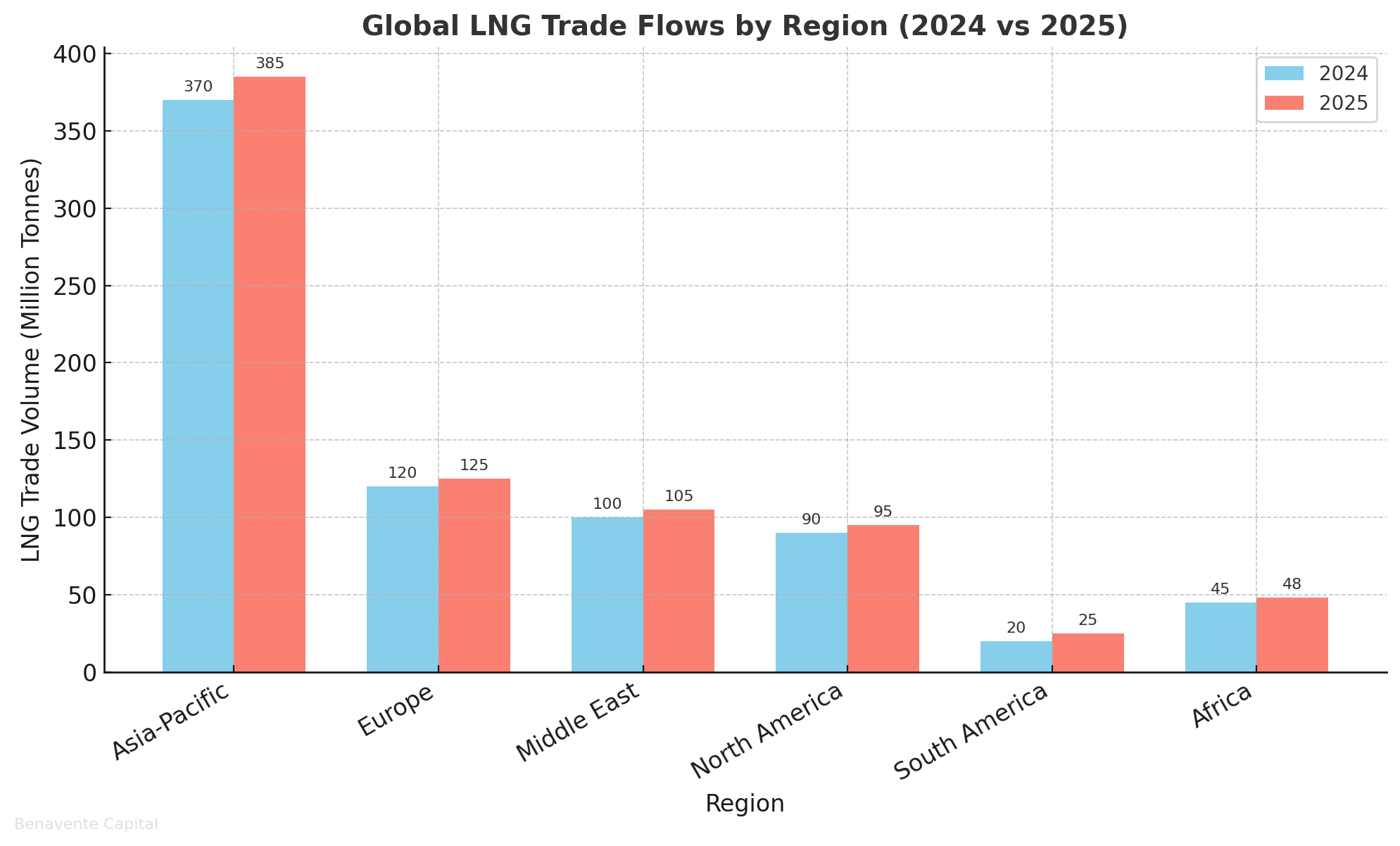

- LNG trade routes are realigning as Europe diversifies away from Russian pipelines while Asia-Pacific buyers lock in flexible long-term contracts.

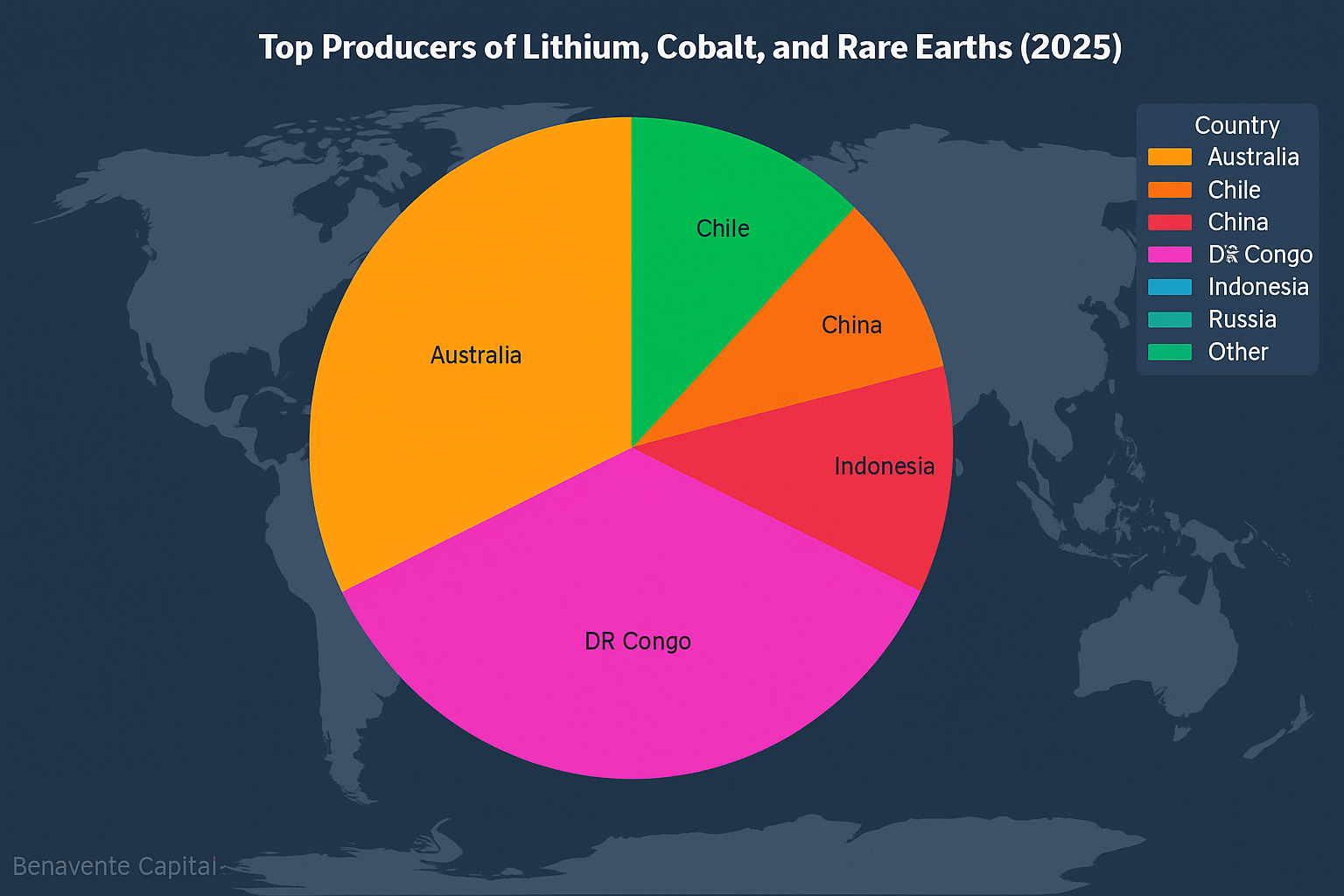

- The green transition is sparking new geopolitical competition over critical minerals like lithium, cobalt, and rare earths.

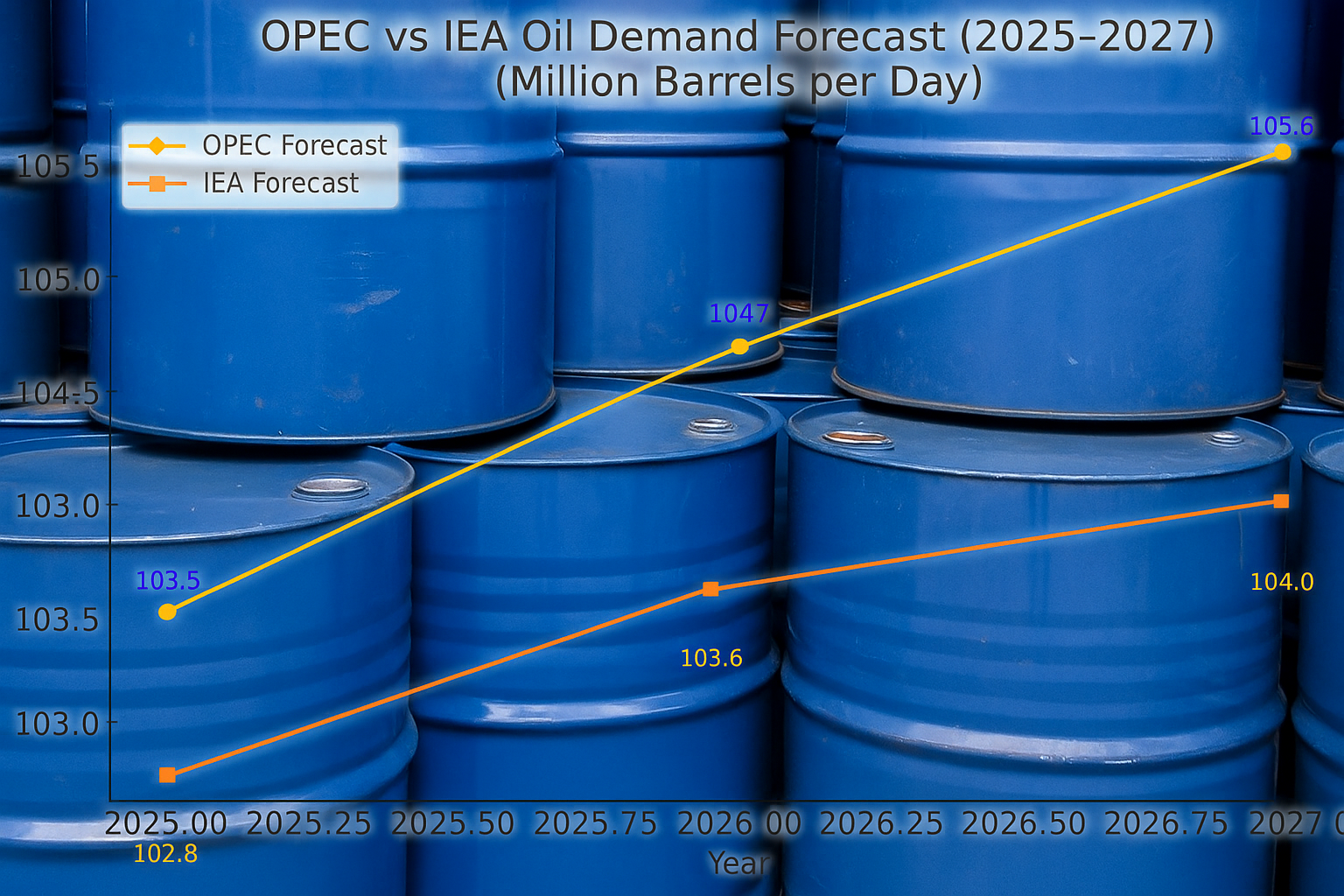

- Forecast gaps between OPEC and the IEA point to uncertainty in oil demand through 2027.

- Strategic risks range from oversupply shocks to infrastructure chokepoints and resource nationalism.

1. OPEC+ Strategy Shift: From Price Support to Market Share

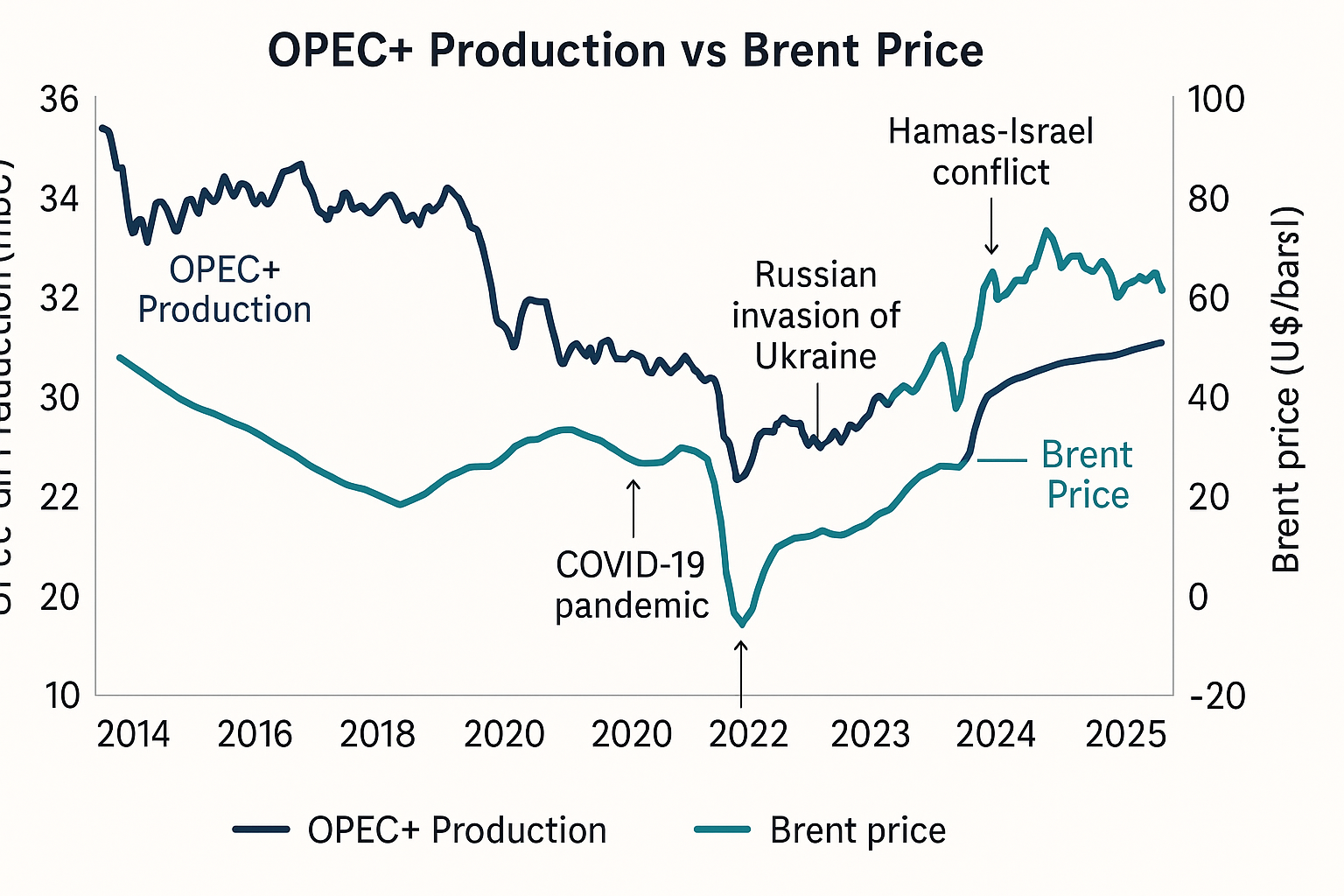

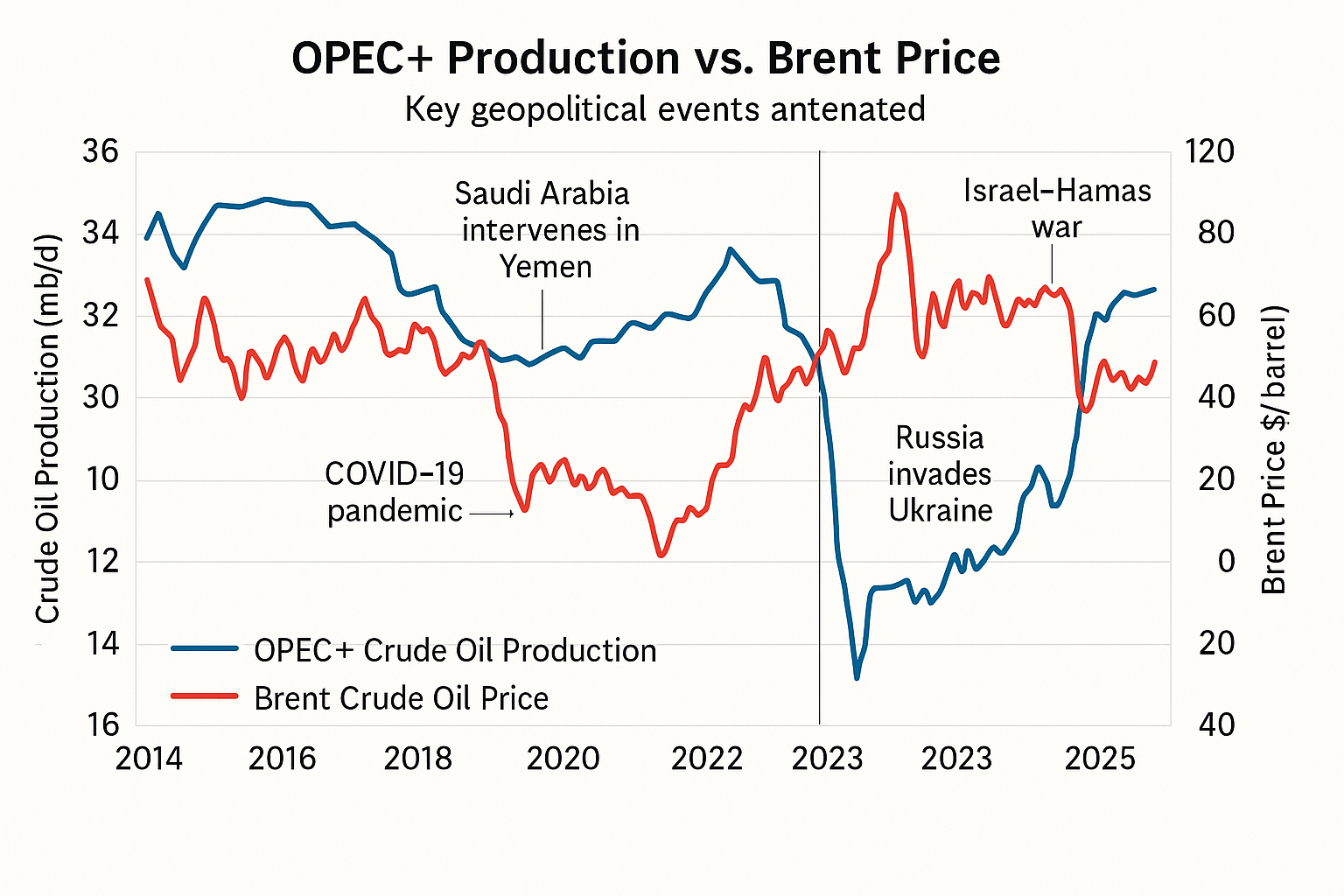

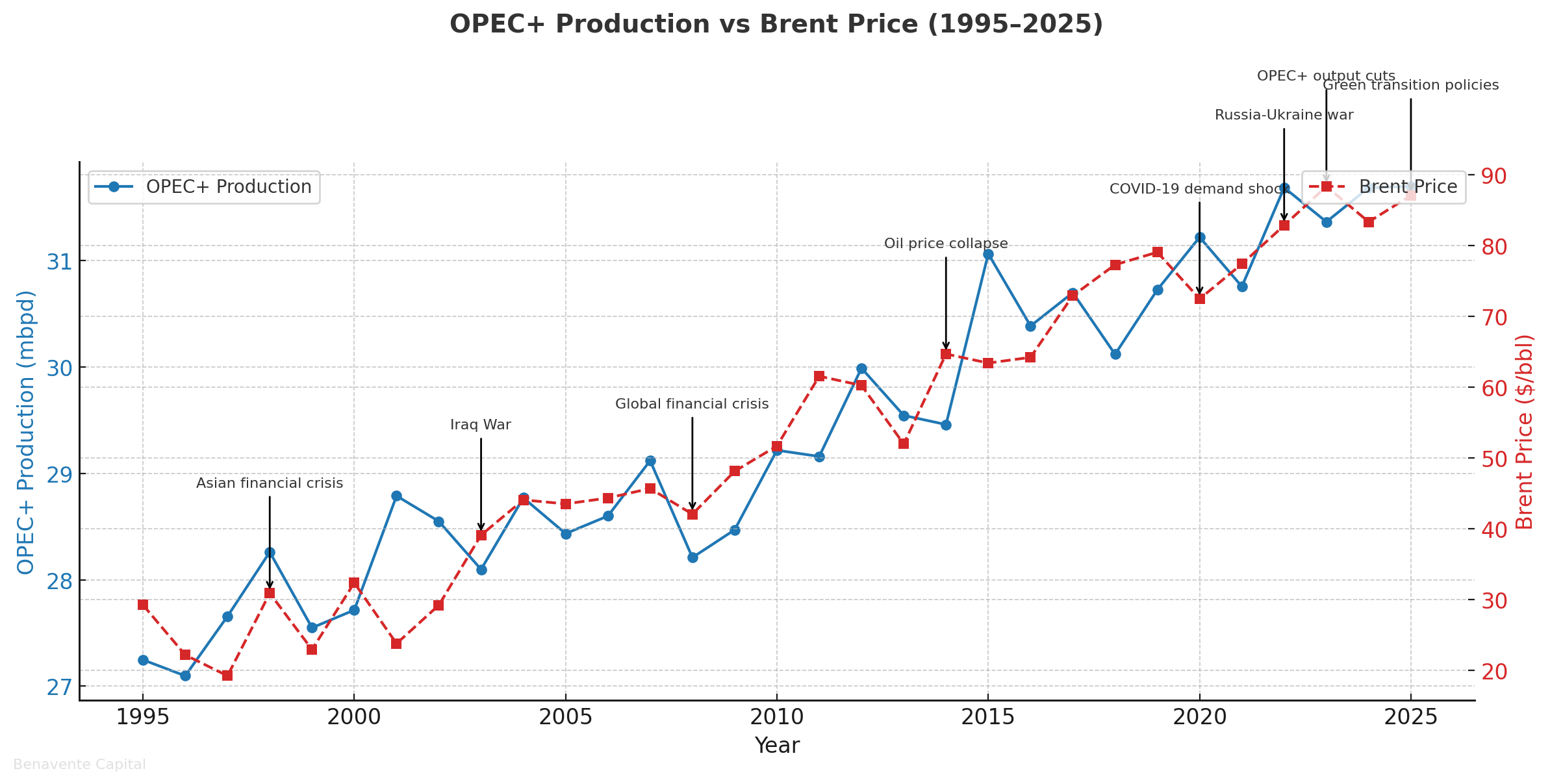

For most of the last decade, OPEC+ has focused on production cuts to defend higher prices. In 2025, the group made a dramatic pivot—restoring output and signaling a shift toward protecting market share rather than prices.

This change follows three key phases:

- 2014–2016: Price war and oil crash as OPEC defended share against U.S. shale.

- 2020–2021: Record pandemic cuts to stabilize prices amid collapsing demand.

- 2022–2024: Coordinated voluntary cuts to support prices during geopolitical uncertainty.

In mid-2025, OPEC+ announced collective output increases of over 500,000 barrels per day, with Saudi Arabia, Russia, and the UAE leading the charge. Brent crude prices fell from the mid-$80s to the high $60s on expectations of increased supply, even as global demand growth slowed to just 700,000 barrels per day—the weakest pace outside the pandemic years.

Risks to Watch:

- Price volatility from sudden policy shifts.

- Overproduction leading to a price slump below $60/bbl.

- Rising tensions within OPEC+ over quota compliance.

2. LNG Routes Realignment: Europe, Asia, and Beyond

The LNG market is undergoing its most significant structural shift in decades. Europe, once reliant on Russian pipelines, has become the world’s largest LNG importer—absorbing U.S., Qatari, and even Russian cargoes despite sanctions.

In Asia, major buyers like Japan, South Korea, and China are renegotiating long-term contracts to increase flexibility. Meanwhile, U.S. LNG export capacity continues to grow, but some projects—like the Alaska LNG pipeline—struggle to secure anchor customers in the Pacific.

Risks to Watch:

- Infrastructure chokepoints at the Suez Canal, Panama Canal, and Strait of Malacca.

- Oversupply risk as new terminals come online in the late 2020s.

- Political backlash over Russian LNG imports in Europe.

3. The Geopolitics of the Green Transition

The transition to clean energy is reshaping global power dynamics—but not replacing fossil fuel politics. Nations rich in critical minerals now command strategic leverage, much like oil producers in the 20th century.

For example:

- Lithium: Dominated by Australia, Chile, and China.

- Cobalt: Concentrated in the Democratic Republic of Congo, with heavy Chinese investment.

- Rare Earths: China controls most production and processing capacity.

As demand for EV batteries and renewable technologies accelerates, competition for these resources is intensifying—prompting some countries to impose export restrictions or seek “friend-shoring” agreements.

Risks to Watch:

- Export restrictions disrupting supply chains.

- Environmental backlash against mining projects.

- Resource nationalism in politically unstable regions.

4. Oil Demand Outlook: OPEC vs IEA Forecasts

A growing divergence between OPEC and IEA demand projections reflects deep uncertainty about the energy transition timeline.

OPEC projects global oil demand will grow by 1.3 million barrels per day in 2025, slowing to 1.0 mb/d in 2026 and 0.9 mb/d in 2027. The IEA is far more conservative, projecting just 0.7 mb/d in 2025 and a plateau before the decade’s end.

Risks to Watch:

- Overinvestment in upstream projects if demand underperforms.

- Underinvestment risk if forecasts prove too pessimistic.

- Policy shocks from climate legislation or carbon pricing.

5. Forward Scenarios: 2025–2027

Energy markets over the next two years could follow sharply different paths depending on supply discipline, geopolitical stability, and technology adoption.

[Chart 4 Placeholder – 2025–2027 Geopolitical Scenarios Table]

Risks to Watch:

- Escalation of conflicts in energy-producing regions.

- Unexpected technology breakthroughs accelerating oil demand decline.

- Financial stress in producer economies from price drops.

Conclusion

The global energy system in 2025 is defined by simultaneous transitions—OPEC’s strategic pivot, LNG’s structural realignment, and the race for critical minerals. These shifts are interdependent, meaning a disruption in one can ripple across the entire system.

For policymakers, investors, and industry leaders, the key is to prepare for volatility while positioning to capture opportunities in both legacy and emerging energy markets.