From Broadcast Powerhouse to Debt Risk: Televisa’s Financial Crossroads

For distressed investors, this is a classic high-risk, high-reward case: either a recovery story where 8–9% long-dated bonds look attractive—or a cautionary tale where subscriber erosion overwhelms balance-sheet discipline.-Rafael Benavente

By Rafael Benavente

Televisa’s Debt Crunch: Can Mexico’s Media Giant Deleverage Its Way Back?

Introduction

Grupo Televisa, Latin America’s largest media company, sits at a crossroads. Once dominant in broadcast TV, the company now faces declining subscribers, weaker revenues, and mounting debt. Bond markets have punished it harshly—some short-dated notes yield nearly 17%, screaming distress.

But behind the headlines, Televisa’s numbers tell a more nuanced story: deleveraging is underway, EBITDA has stabilized, and long-term projections suggest gradual improvement. The big question: is this a turnaround in progress or just a temporary reprieve?

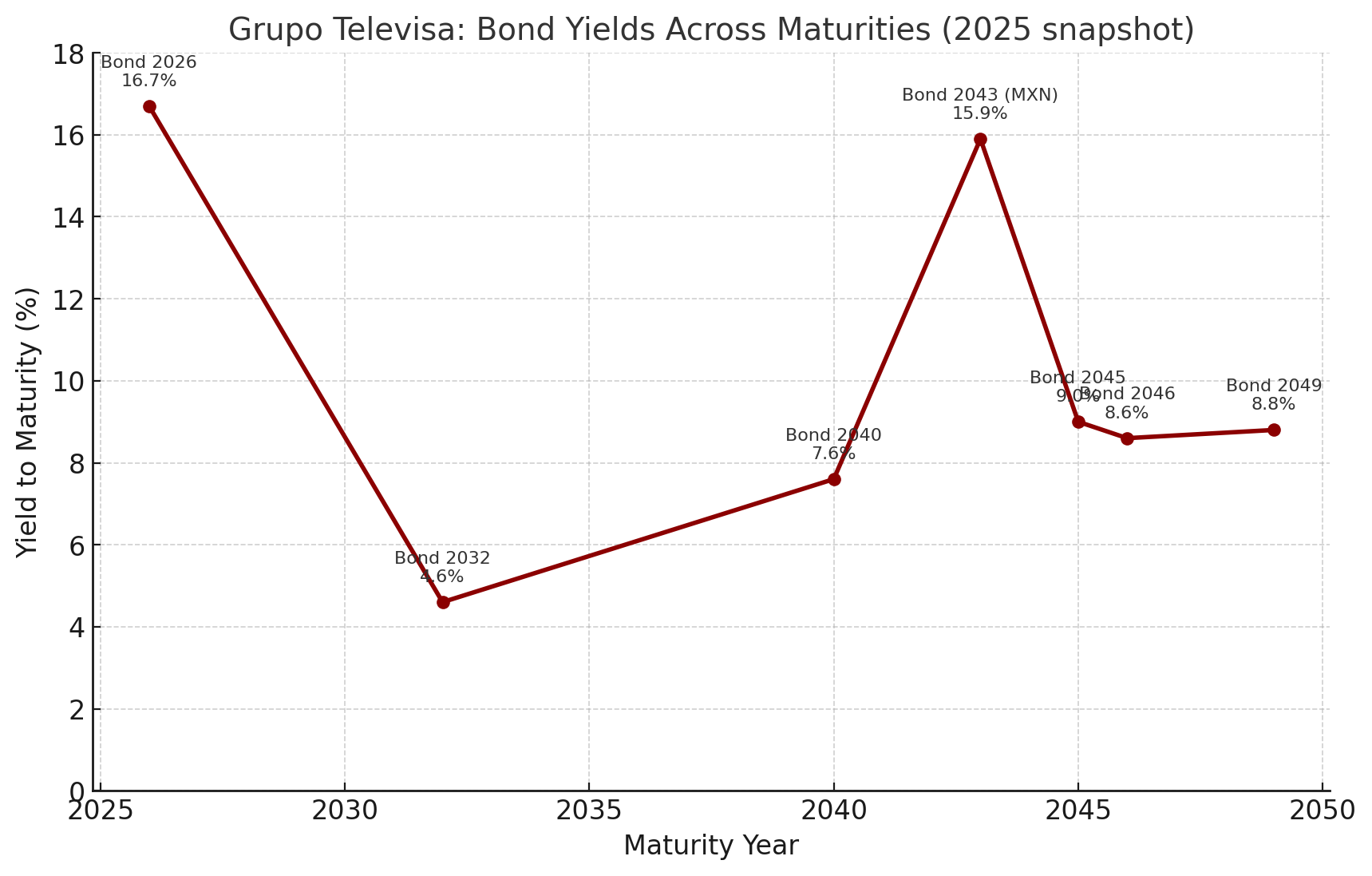

Bond Market Signals: Distress in Plain Sight

Televisa’s bonds show the tension clearly.

- The 2026 bond trades near 16.7% yield, reflecting immediate credit stress.

- Medium maturities (2032–2040) sit between 4.6%–7.6%, suggesting selective investor appetite.

- The MXN-denominated 2043 bond trades near 15.9%, weighed by FX risk.

- Longer USD bonds (2045–2049) hover around 8–9%.

👉 The curve shows short-term panic pricing, while long maturities reflect a market betting Televisa survives—but at a steep cost.

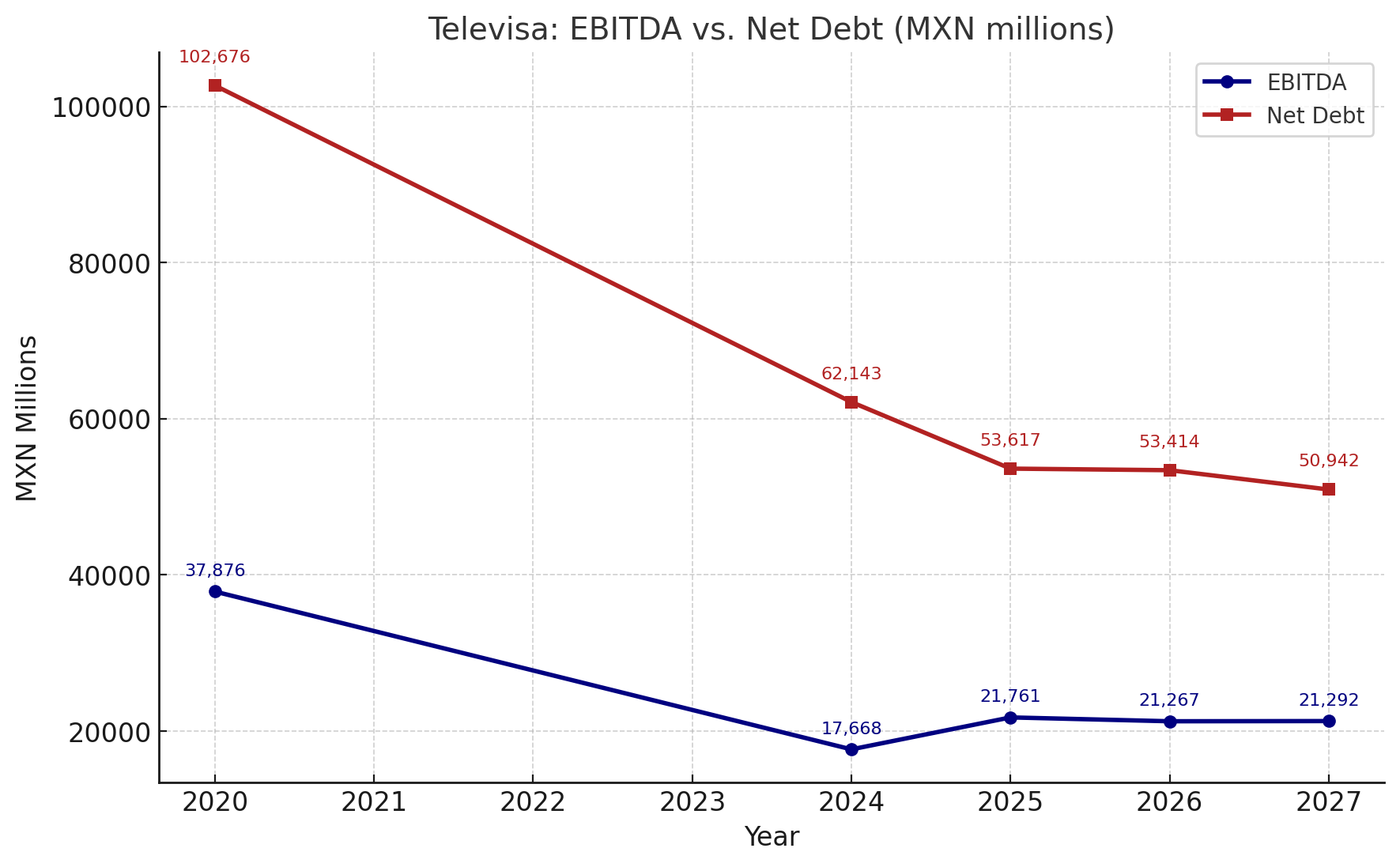

Operating Income & EBITDA Trends

Televisa’s EBITDA collapsed from ~MXN 38B in 2020 to just ~MXN 18B in 2024, driven by subscriber churn and competition. Projections suggest stabilization at ~MXN 21B through 2027.

At the same time, net debt dropped from MXN 103B (2020) to ~MXN 62B (2024) and is projected to decline further toward MXN 51B by 2027. This parallel movement signals an active deleveraging strategy.

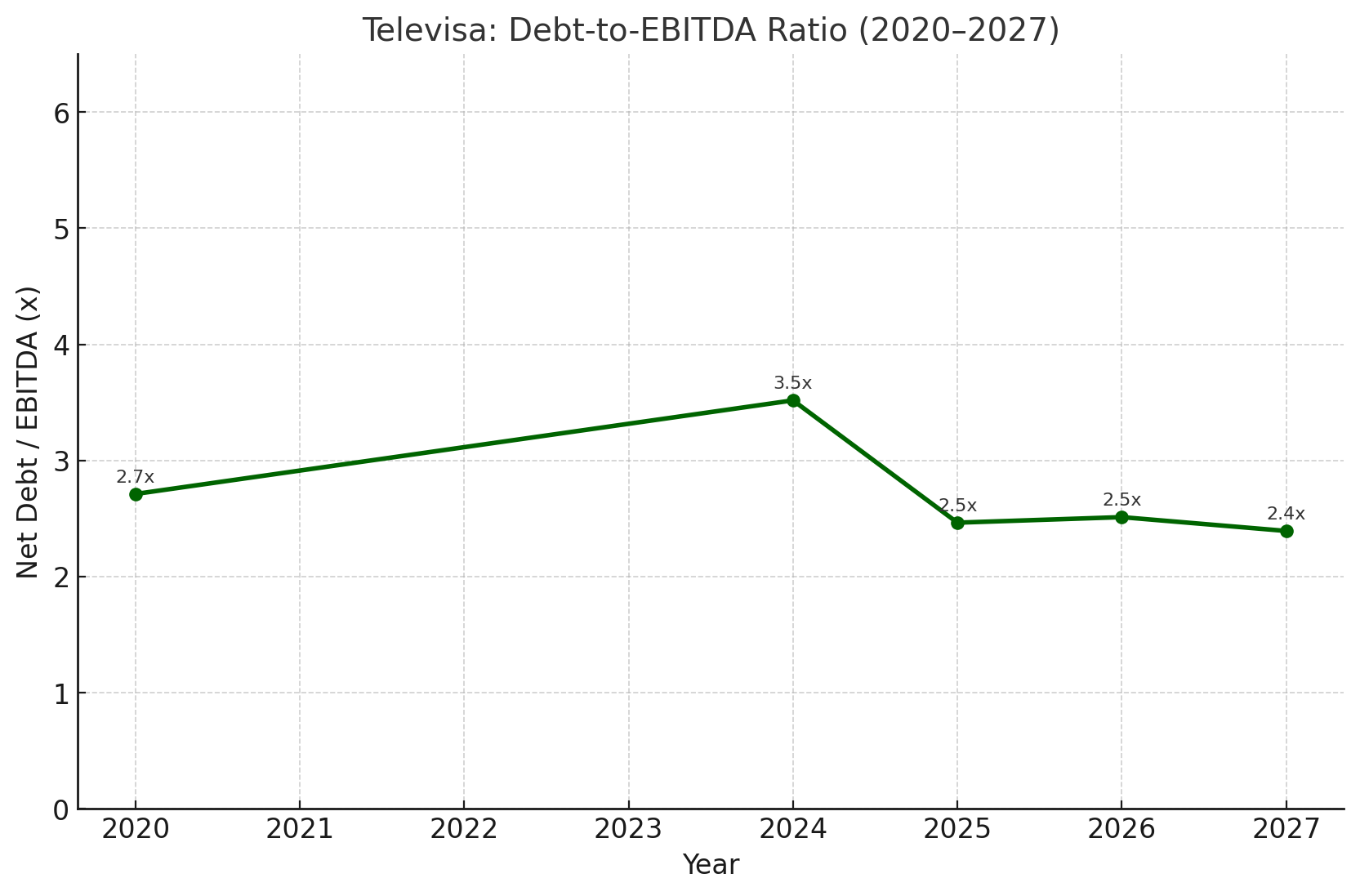

Debt-to-EBITDA: Stress Now, Relief Later

A clearer way to track credit risk is the Debt-to-EBITDA ratio.

- 2020: ~2.7x leverage

- 2024: Spikes to 3.5x amid EBITDA collapse

- 2025–2027: Falls back toward ~2.4x

👉 This shows Televisa is not spiraling indefinitely; rather, it is grinding through a painful peak in leverage.

Business Outlook

- Revenues: 2025 guidance is MXN 59B, stabilizing around MXN 58B into 2027.

- Operating income: After near-zero in 2024, EBIT is projected to rebound to MXN 4.5B by 2027.

- Capex: Slashed to USD 600M in 2025, improving cash preservation.

- Free cash flow: Expected to remain positive, supporting debt reduction.

Investor Takeaways

- Near-term bonds (2026): reflect default-like pricing—high risk, high potential upside.

- Longer maturities (2045–2049): investors price in survival but at an elevated yield.

- Credit trajectory: Debt-to-EBITDA easing suggests risk could decline gradually, but execution remains critical.

Final Word

Televisa’s story is one of distress but not collapse. Short-term debt markets are in panic mode, but projections show a company cutting costs, stabilizing operations, and grinding leverage lower.

For distressed investors, this is a classic high-risk, high-reward case: either a recovery story where 8–9% long-dated bonds look attractive—or a cautionary tale where subscriber erosion overwhelms balance-sheet discipline.

By Rafael Benavente