Goldman Says Yes, JPM Says Maybe: A Look at Fed Rate Cut Predictions

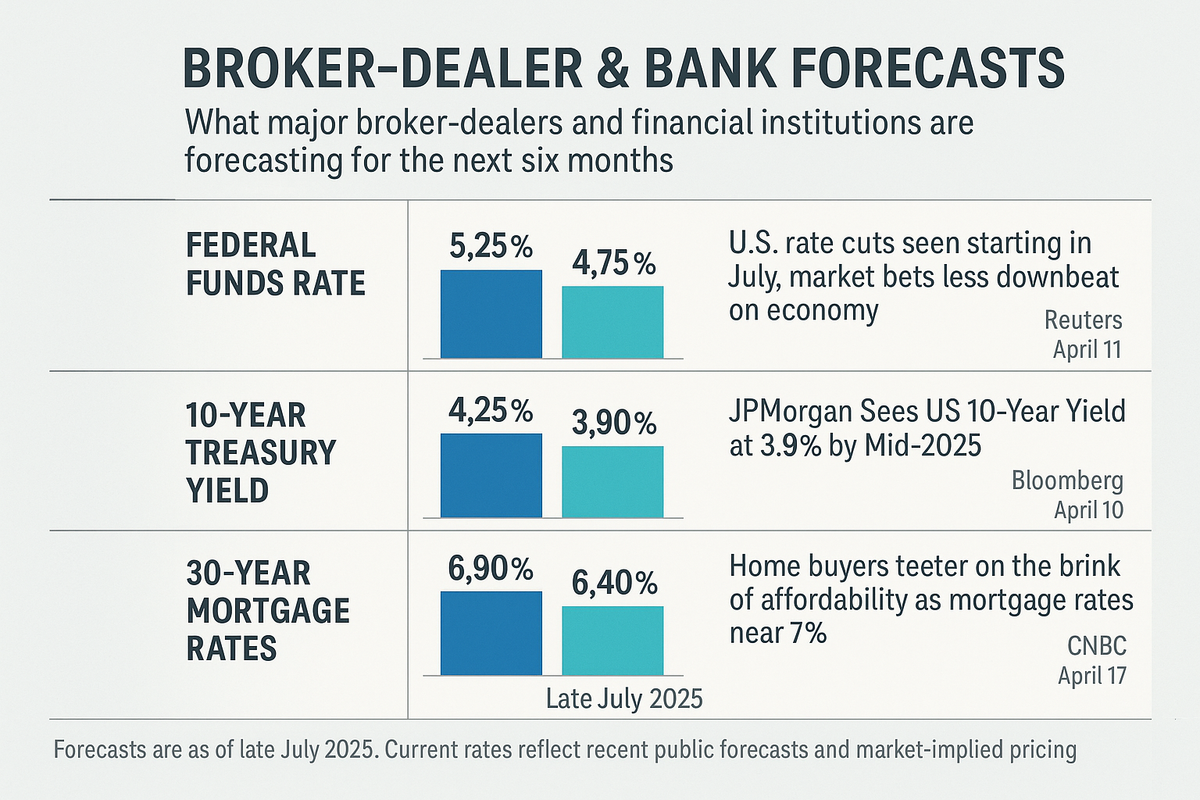

Here’s a fully structured outlook report on what major broker‑dealers and financial institutions are forecasting for the next six months—including the federal funds rate, the 10-year Treasury yield, and 30‑year mortgage rates. My research covers recent public forecasts and market‑implied rates as of late July 2025. Relevant news citations are added for context.

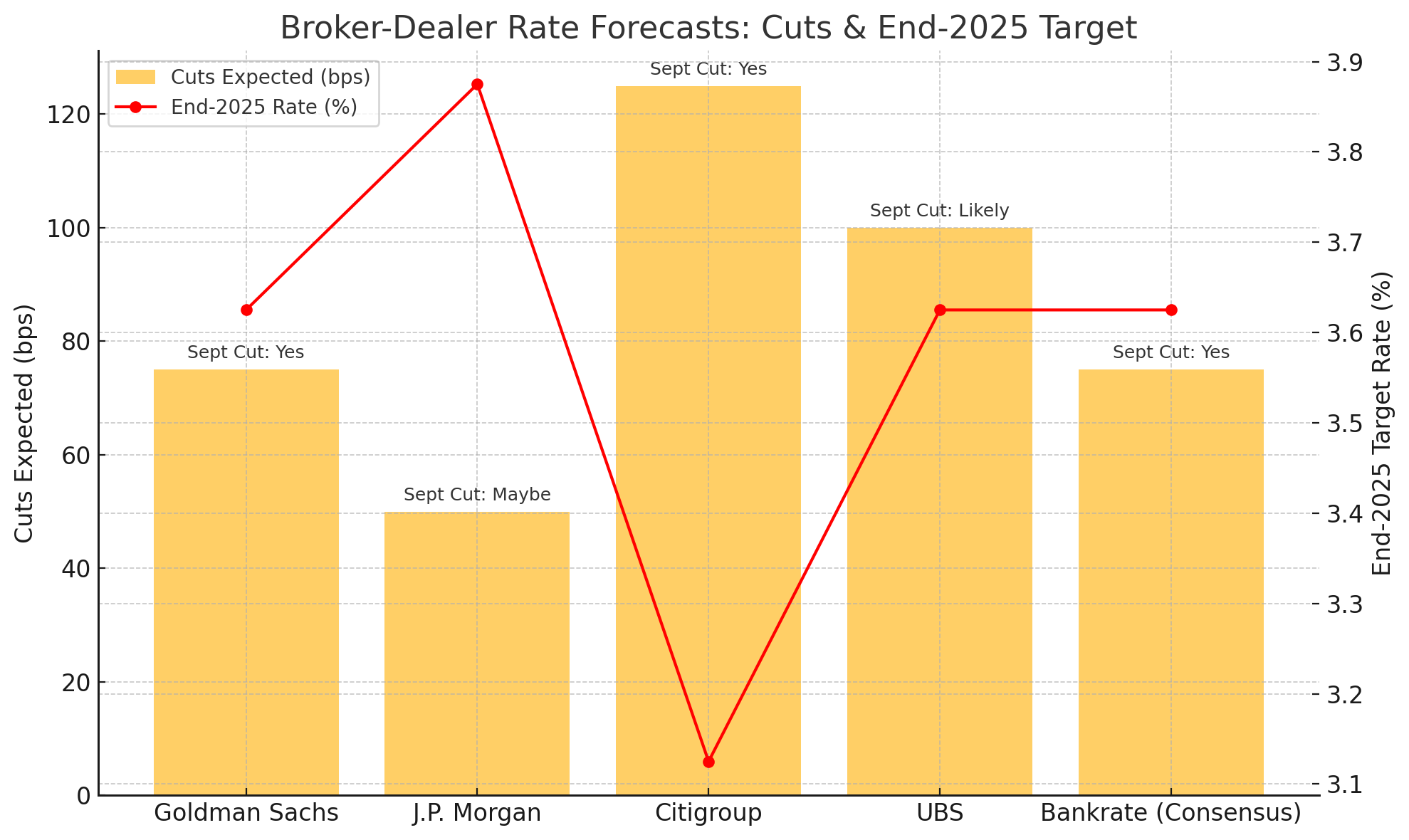

| Broker‑Dealer | Number of Cuts in 2025 | Cut in September 2025 | Expected Fed Funds Rate by End‑Dec 2025 |

|---|---|---|---|

| Goldman Sachs | 3 cuts (Sept, Oct, Dec) | ✅ Yes – first cut in September | ~3.50%–3.75% (Reuters, marketinsights.citi.com, MarketWatch) |

| J.P. Morgan | 2 cuts | Possibly (likely October‑onward) | ~3.75%–4.00% (Reuters, JPMorgan) |

| Citigroup | ~5 cuts (up to 125 bps) | Yes – starting by mid‑year (possibly June/Sept) | ~3.00%–3.25% (MarketWatch, Reuters) |

| UBS | Cuts totaling ~75–100 bps | Likely two cuts, possibly starting in September | ~3.50%–3.75% (Reuters) |

| Bankrate consensus (Greg McBride) | 3 cuts | Yes, first likely in September | ~3.50%–3.75% (Bankrate) |

1. Fed Funds Rate (Federal Target Rate)

- The Federal Reserve currently holds the federal funds rate at 4.25%–4.50% following its June 18 and July 31 FOMC meetings U.S. Bank+1Wikipedia+1.

- Futures markets expect a gradual decline, projecting:

- ~4.11% by October 2025

- ~3.85% by January 2026 (≈ six months out)

- ~3.65% by April 2026 NerdWallet+2StreetStats+2Financial Times+2.

- Private research:

- J.P. Morgan expects cuts begin in June 2025, bringing the target range to 3.75–4.00% by mid‑year Wikipedia+15JPMorgan+15Transamerica+15.

- iShares / BlackRock projects a similar path: two 25‑bps cuts leading to 3.75–4.00% in first half of 2025, then a pause BlackRock+1NerdWallet+1.

- Transamerica also sees approximately 3.75–4.00% by end‑2025, with two quarter‑point cuts JPMorgan+2Transamerica+2BlackRock+2.

Summary: Most broker‑dealer forecasts converge around 3.75–4.00% federal funds rate in six months (i.e. January–April 2026), down modestly from the current ~4.3%.

2. 10‑Year Treasury Yield

- While explicit broker forecasts are less published, firm projections by Transamerica suggest the 10‑year yield remains close to current levels, ending around 4.50% by year-end 2025 US News Money+6Transamerica+6Barron's+6.

- Bloomberg-type and market-implied projections show that yields have recently ticked up amid hawkish Fed commentary and persistent inflation concerns Barron's+1New York Post+1.

- Fannie Mae / National Association of Home Builders estimate a 10‑year Treasury yield around 3.53% on average in 2025, though as of now yields are higher than that, so this may be optimistic Rocket Mortgage.

Summary: Best consensus range is 4.3% to 4.6% for the 10‑year Treasury in six months; Transamerica targets ~4.50%. Broker forecasts tend to cluster near this level.

3. 30‑Year Fixed Mortgage Rates (30‑Year FRM)

- Current average: ~6.72%, per Freddie Mac (week ending July 31, 2025) The Mortgage Reports+8Money+8First Tuesday Journal+8.

- Forecasts:

- Fannie Mae expects mortgage rates to average ~6.5% in Q2–Q3 2025 and ~6.20% by year‑end 2025 Fannie Mae+4NerdWallet+4Business Insider+4.

- Mortgage Bankers Association (MBA) forecasts ~6.7% through late 2025, easing slowly toward 6.4% in 2026 Business InsiderNerdWallet.

- National Association of Realtors (NAR) projects ~6.4% average in 2025, edging down to 6.1% in 2026 Business Insider.

- NAHB forecasts an average of ~6.66% in 2025, then dropping to ~6.16% in 2026 Business Insider.

Summary: Rates are expected to be near 6.5% now, edging down modestly toward 6.2%–6.4% over the next six months.

🧾 Summary Table

| Rate Type | Current Level | 6‑Month Forecast (Jan–Apr 2026) |

|---|---|---|

| Fed Funds Rate | 4.25%–4.50% (~4.33% effective) | ~3.75%–4.00% |

| 10‑Year Treasury Yield | ~4.3%–4.5% | ~4.3%–4.6% (often ~4.5%) |

| 30‑Year Mortgage Rate | ~6.70% | ~6.2%–6.4% |

🔎 Commentary & Risks

- Fed remains cautious: Chair Powell has emphasized data dependence and no firm timeline for cuts, leading markets to trim September cut odds from ~65% to ~45–50% AP News+12StreetStats+12Chase+12New York Post+11Reuters+11Transamerica+11TransamericaWikipedia.

- Inflation persistence: Core PCE around 2.8% (above the 2% target) has muted hopes for rapid easing New York Post.

- Labor market strength: Unemployment around 4.1% supports maintaining tighter policy The Australian+2Reuters+2Reuters+2.

- Geopolitical/tariff pressures may lead to further inflation surprises, affecting both Treasury yields and mortgage rates.